Car Sales Tax By State . These car registration fees are for passenger cars only; Below, we list the state tax rate, although your city or county government may add its own sales vehicle registration fees, insurance, and other costs by state for 2021.

Solved The Sales Tax Rate For The State Of Washington Was Chegg Com from media.cheggcdn.com In most states, car sales tax is calculated based on the top line selling price of the vehicle, plus any dealer installed equipment and dealership documentation fees. New jersey car sales tax applies to the vehicle purchase price before you factor in any rebates or incentives. Here's everything you need to know. It may seem hard to understand, but it's not an insurmountable task. What buyers rarely realize is that the sales tax can be a major expense.

What buyers rarely realize is that the sales tax can be a major expense. Some states charge sales tax on the disposition fee when it is paid. While you may be used to paying sales tax for most of your purchases, the bill for sales tax on a vehicle can be shocking. Many states allow local governments to charge a local. A sales tax is an involuntary fee imposed by the government on the sale of goods and services, calculated as a percentage of the price of a purchase. Do you pay state taxes on a leased car? I was worried i would have to.

Source: www.madisoncountyal.gov Generally, you pay sales tax where you live, when you go to register the car and transfer the title. How car leases are taxed. Sales tax on a new vehicle can take people by surprise. Sales tax is governed at the state level and no national general sales tax exists.

Most states have a car sales tax plus motor vehicle fees. Many states allow local governments to charge a local. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. On new vehicles, the top line selling price only includes dealership discounts from the manufacturer's suggested retail price and not.

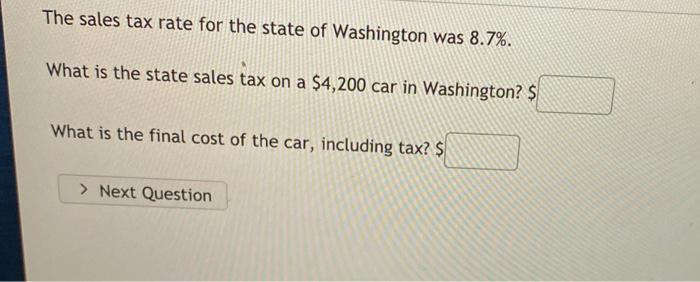

Washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on the purchase or in addition to taxes, car purchases in washington may be subject to other fees like registration, title, and plate fees. How to sell your car to dealers and trading in your car can bring sales tax benefits if you buy another car from the dealer at the same time. The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in texas, if the motor vehicle has a gross weight of 11,000 pounds. The taxable total of a purchased car is reached in one of two ways.

Source: img.forconstructionpros.com Most states in the u.s charge sales tax on cars. Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Imagine paying 8% sales tax on a $15,000 car, that's an additional $1,200 you have to spend without even considering dmv and documentation and registration fees. On new vehicles, the top line selling price only includes dealership discounts from the manufacturer's suggested retail price and not.

It may seem hard to understand, but it's not an insurmountable task. Taxes were based on the average car transaction amount of $37,876 in february 2020 as reported by kelley blue book; Here's everything you need to know. For example, a 9% sales tax on a $30,000 car is $2,700.

Sales taxes are generally collected on all sales of tangible goods (and sometimes services) completed within the state, although several states have this table, and the map above, display the base statewide sales tax for each of the fifty states. Depending on the state, you may be able to roll the sales tax into your monthly lease payment (a common tactic). Alaska, delaware, montana, new hampshire, and oregon. Below, we list the state tax rate, although your city or county government may add its own sales vehicle registration fees, insurance, and other costs by state for 2021.

Source: electrek.co These rates can be substantial, so a state with a moderate statewide five states do not have statewide sales taxes: The use tax applies to all other types of transfers of title or possession where the vehicle transferred is stored, used, or consumed in massachusetts. The sales tax applies to transfers of title or possession through retail sales by registered dealers or lessors while doing business. Below, we list the state tax rate, although your city or county government may add its own sales vehicle registration fees, insurance, and other costs by state for 2021.

Most states have a car sales tax plus motor vehicle fees. A sales tax is an involuntary fee imposed by the government on the sale of goods and services, calculated as a percentage of the price of a purchase. The use tax applies to all other types of transfers of title or possession where the vehicle transferred is stored, used, or consumed in massachusetts. Of these, alaska allows localities to.

Car tax is paid based on the state where the car is first registered, so if you live in california and buy a car in oregon, you will have to pay when you register the car back in. It may seem hard to understand, but it's not an insurmountable task. Sales tax is governed at the state level and no national general sales tax exists. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees.

Source: wb-qb-sg-oss.bytededu.com All but five states charge sales tax on vehicles, whether bought or leased. For example, a 9% sales tax on a $30,000 car is $2,700. Most states in the u.s charge sales tax on cars. Sales tax on a new vehicle can take people by surprise.

Alaska, delaware, montana, new hampshire, and oregon. Some states may charge sales tax on any down payment you make for your car lease. It may seem hard to understand, but it's not an insurmountable task. Cities and counties frequently add their own tax on top of the state tax, so the amount you pay can vary within a state.

United states vehicle sales tax varies by state, and often by counties, cities, municipalities, and localities within each state. On new vehicles, the top line selling price only includes dealership discounts from the manufacturer's suggested retail price and not. Legally, the sales tax due on a vehicle transaction are triggered at the moment of the transaction. The downside is that you can't deduct your state and local income taxes and.

Source: files.taxfoundation.org Taxes were based on the average car transaction amount of $37,876 in february 2020 as reported by kelley blue book; Legally, the sales tax due on a vehicle transaction are triggered at the moment of the transaction. We've listed the maximum sales tax rate here. United states vehicle sales tax varies by state, and often by counties, cities, municipalities, and localities within each state.

Nevada, maine and minnesota don't have the absolute highest statewide auto sales tax rates, but combine fairly high rates with high average dmv fees, and drivers in these states pay around $3,000 for the average new car and nearly $2,000. Washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on the purchase or in addition to taxes, car purchases in washington may be subject to other fees like registration, title, and plate fees. Generally, you pay sales tax where you live, when you go to register the car and transfer the title. How to sell your car to dealers and trading in your car can bring sales tax benefits if you buy another car from the dealer at the same time.

What buyers rarely realize is that the sales tax can be a major expense. Here's everything you need to know. The downside is that you can't deduct your state and local income taxes and. All but five states charge sales tax on vehicles, whether bought or leased.

Thank you for reading about Car Sales Tax By State , I hope this article is useful. For more useful information visit https://thesparklingreviews.com/

Post a Comment for "Car Sales Tax By State"